do nonprofits pay taxes on interest income

First and foremost they arent required to pay federal income taxes. Nonprofit businesses are allowed to earn interest on their checking accounts.

June 30 2021.

. While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS. Nonprofits are exempt from federal income taxes based on IRS subsection 501c. This is true for any nonprofit no matter their status.

However this corporate status does not automatically grant exemption from federal income tax. If a nonprofit has over 1000 of UBTI it must file Form 990-T and pay tax on that income. Did you know that sometimes nonprofits must pay income tax.

Nonprofits are usually required to disclose interest income to the IRS and authorities in some states even though theyre not liable for tax on it. Do nonprofits pay taxes on investment income. Your recognition as a 501 c 3 organization exempts you from federal income tax.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for. Monday April 25 2022. Most are also exempt from state and local property and sales taxes.

All nonprofits are exempt from federal corporate income taxes. For tax years beginning after Dec. Yes nonprofits must pay federal and state payroll taxes.

This tax must be reported on Form 990-PF Return of. Do Nonprofits Pay Taxes. A nonprofit that identifies as a 501c3 is.

Up to 25 cash back Sometimes nonprofits make money in ways that arent related to their nonprofit purposes. In short the answer is both yes and no. Below well detail two scenarios in which nonprofits pay tax.

Just because you have a tax-exempt status it does not mean that youre well tax exempt. If the nonprofit is structured as a corporation it will pay the flat 21 percent rate on that income like the 21 percent tax paid by for-profit corporations. Generally the first 1000 of unrelated income is not.

20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate. General Rule By and large interest is not subject to income tax for nonprofit corporations. There are some instances when nonprofits and churches are still required to pay taxes.

Which Taxes Might a Nonprofit Pay. And there are several types of 501c3 charitable. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue.

Nonprofits engage in public or private interests without a goal of monetary profits. In short the answer is both yes and no. Do nonprofit organizations have to pay taxes.

Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission. But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. Most nonprofits do not have to pay federal or state income taxes.

If its set up as a trust it will be taxed at trust rates the highest of which is 37 percent. Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is not considered UBTI and therefore is tax exempt. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT.

And it doesnt stop there. Additionally the income or gain. Do nonprofits pay taxes on interest income Saturday March 19 2022 Edit While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company.

While the IRS usually excludes investment income from a nonprofits taxed unrelated business income it will usually tax investment income from for-profit subsidiaries or controlled nonprofits. A large percentage of 501 c 3 nonprofits are also exempt from. However here are some factors to consider when determining what taxes a nonprofit may have to pay.

However there are two exceptions where this type of income is taxable. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. The IRS incorporated into the tax codes something called Unrelated Business Income UBI and its especially for nonprofit organizations.

Being tax exempt means an organization doesnt pay federal taxes but they still have to provide the IRS with the information they need. Some banks offer interest-bearing accounts specifically geared to them. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Whether a nonprofit corporations interest is subject to income tax depends the incomes source. For tax years beginning on or before Dec. Excluding foundations one in five nonprofits receives at least 5 percent of its income from investments.

Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Investment income is reported on Line 10 of.

To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to. However they arent completely free of tax liability. Do nonprofits pay taxes.

There are 29 different types of nonprofits in the IRS tax code.

Statement Of Financial Activities Nonprofit Accounting Basics

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Tax Breaks For Homeowners And Renters Tax Deductions Deduction Renter

Organization Budget Template Yahoo Image Search Results Budget Template Nonprofit Startup Budget Organization

Click To View The Full Size Infographic On Corporate Sponsorship Sponsorship Proposal Nonprofit Startup Fundraising Letter

The Inspiring 10 Treasurers Report Template Resume Samples For Fundraising Report Template Photo Below Is Other Budget Template Budgeting Budget Spreadsheet

Pin By Michelle Higgins On Nonprofits Financial Responsibility Non Profit Executive Director

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors Chart Of Accounts Accounting Dental Insurance

Non Profit Vs For Profit Accounting Differences Genesa Cpa Corp

Different Concepts For Nonprofit Organizations Start A Non Profit Nonprofit Startup Nonprofit Marketing

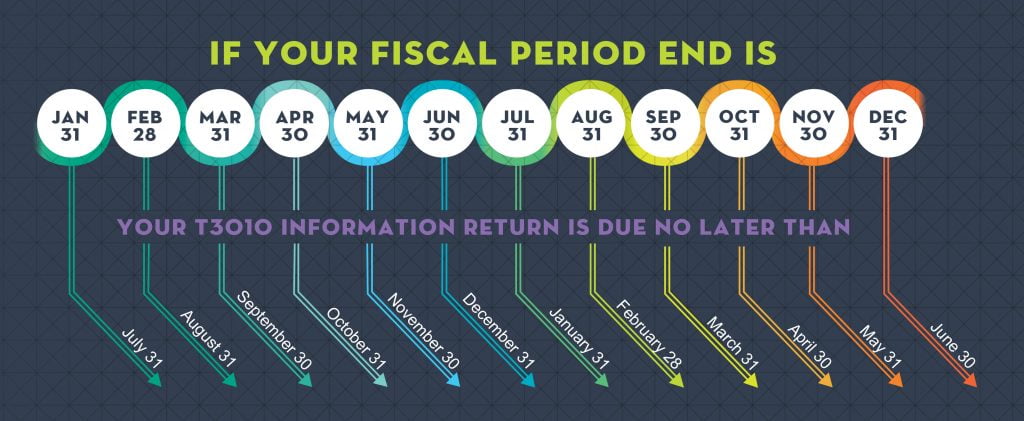

Canadian Tax Requirements For Nonprofits Charitable Organizations

Statement Of Financial Activities Nonprofit Accounting Basics

Statement Of Financial Activities Nonprofit Accounting Basics

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Nonprofit Program Budget Template 8 Non Profit Budget Template The Importance Of Having Non Profit Budget Te Budgeting Worksheets Budget Template Budgeting

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)